Content

At any time you can also switch strategies by asking the the SSA to stop withholding taxes. 2.35% Medicare tax (regular 1.45% Medicare tax + 0.9% additional Medicare tax) on all employee wages in excess of $200,000.

- Small, midsized or large, your business has unique needs, from technology to support and everything in between.

- Assets in taxable accounts are the next most tax-efficient to inherit because thecost basisof the investments will bestepped upfor thebeneficiary, alleviatingcapital gainstaxes.

- At NerdWallet, our content goes through a rigorous editorial review process.

- Since the exemption for joint filers phases out between $60,000-$70,000, this filer would be eligible for a partial exemption.

- Individuals who are not US-domiciled are subject to US federal estate tax on only US-situs assets.

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Then, on Form 1040, you will write the total amount of your Social Security benefits on line 5a and the taxable amount on line 5b. Social Security and Supplemental Security Income benefits will increase by 8.7% in 2023. The average monthly Social Security benefit will increase from $1,681 to $1,827, and the maximum federal SSI monthly payment to an individual will increase from $841 to $914. The maximum federal SSI monthly payment to a couple will increase from $1,261 to $1,371 in 2023. The amount of earnings that is required in order to be credited with a quarter of Social Security coverage will increase from $1,510 to $1,640. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider.

Paying Taxes on Social Security

This also includes benefits and provisions that do not qualify as wage based on the wage tax law , e.g. employers’ contributions to approved/qualifying employee pension plans. Social Security is financed via dedicated payroll taxes. In 2022, employers and employees will each pay 6.2% of wages, adding up to a taxable maximum of $147,000, while self-employed people pay 12.4% to finance Social Security. Some employees pay more Social Security taxes than they need to.

So, when you calculate your combined income for Social Security tax purposes, your withdrawals from a Roth IRA won’t count as part of that income. That could make a Roth IRA a great way to increase your retirement income without increasing your taxes in retirement. If your Social Security income is taxable, the amount you pay will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income. The retirement earnings test remains in effect for individuals below normal retirement age who continue to work while collecting Social Security benefits. For affected individuals, $1 in benefits will be withheld for every $2 in earnings above $21,240 in 2023 (up from $19,560 in 2022). The American Taxpayer Relief Act of 2012 increased the top estate, gift, and generation-skipping transfer tax rates from 35% to 40% for estates of decedents dying after 31 December 2012.

Married Tax Rates

Employers have to withhold taxes — including FICA taxes — from employee paychecks because taxes are a pay-as-you-go arrangement in the United States. When you earn money, the IRS wants its cut as soon as possible. Withholding taxis an income tax that a payer remits on a payee’s behalf . The payer deducts, or withholds, the tax from the payee’s income.

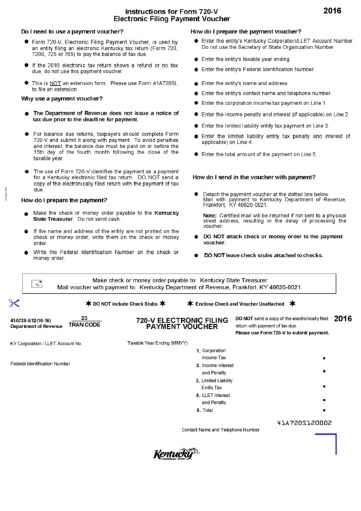

- Federal payroll taxes are paid online using the Electronic Federal Tax Payment System.

- An ITIN is an identification number issued by the U.S. government for tax reporting only.

- In 2022, Social Security taxes are 6.2% of the gross income of up to $147,000.

- Social Security tax rates are determined by law each year and apply to both employees and employers.

If your combined gross income is less than $25,000, your entire SS income is tax-free. The law sets payroll tax rates for wages up to a certain amount. This amount, known as the earning base, increases as average earnings increase. Some employers can use Form 944, Employer’s Annual Federal Tax Return, to report Social Security taxes withheld and contributed. The annual form also reports Medicare and federal income taxes.

How Much of Your Social Security Income Is Taxable?

There is no limit to https://intuit-payroll.org/ subject to the Medicare Tax. All covered wages are still subject to the tax at 1.45%.

Opinion Biden’s Promises on Social Security and Medicare Have No Basis in Reality – The New York Times

Opinion Biden’s Promises on Social Security and Medicare Have No Basis in Reality.

Posted: Tue, 21 Feb 2023 11:42:52 GMT [source]

This means they’re not subject to Social Security Tax Rates ation when the funds are withdrawn. Thus, the distributions from your Roth IRA are tax-free, provided that they’re taken after you turn 59½ and have had the account for five or more years. As a result, the Roth payout won’t affect your taxable income calculation and won’t increase the tax you owe on your Social Security benefits. Notably, on March 27, 2020, former President Trump signed a$2 trillion coronavirus emergency stimulus package, called theCoronavirus Aid, Relief, and Economic Security Act, into law.

US Tax research and insights

DE, HI and VT do not support part-year/nonresident individual forms. Most state programs available in January; software release dates vary by state. State e-File for business returns only available in CA, CT, MI, NY, VA, WI. Federal pricing will vary based upon individual taxpayer circumstances and is finalized at the time of filing. Social Security is taxable based on your total income, not age; however, the taxable amount varies from zero to 85% depending on your total income. If you and your spouse file jointly, you’ll owe taxes on half of your benefits if your joint income is in the $32,000–$44,000 range. If your income exceeds that, then up to 85% is taxable.

- Payroll software automates FICA calculations, deductions and payments to help ensure accuracy.

- Social Security is one of the two Federal Insurance Contributions Act taxes.

- The employer Social Security tax rate and the Social Security Wage Base were not directly impacted by this act, though they did change; only the employee’s tax rate changes.

- Learn how we can tackle your industry demands together.

- If you think you could be subject to high marginal rates, you may want to fund additional spending needs with income sources that generate little or no taxable income.

- Supplemental Security Income payments aren’t taxable.